Active managers “turned the tide” in the battle against passive funds in 2020, with fund sectors outperforming indices in the majority of major equity sectors during the year.

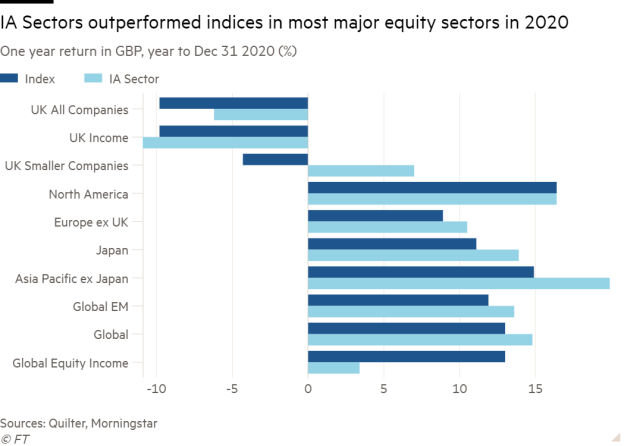

Data collected by Quilter showed active equity managers outperformed market indices in seven of the 10 major Investment Association sectors, struggling predominantly in income-oriented portfolios.

Active managers performed best in the UK Smaller Companies sector, outperforming the index by 11 per cent, while the average UK All Companies fund was nearly 4 per cent ahead of the index.

The trend was also found in overseas funds. Those invested in global, continental Europe, Japan and emerging market equities were at least 1.6 per cent ahead of the index and returning up to 5 per cent more.

Meanwhile income managers struggled to beat the index, primarily as a result of their inherent value bias and huge dividend cuts in 2020, returning 1 per cent less than the index in the UK Income sector and nearly 10 per cent less in the Global Equity Income category.

Nick Wood, fund expert at Quilter, said: “It seems active management has done a reasonable job in 2020 particularly given the extraordinary circumstances we faced during the pandemic.

“With the sharp recovery in share prices, and a handful of tech stocks benefitting active managers, it is certainly a change in fortunes given recent history has tended to favour passive investing as a strategy.”

Darius McDermott, managing director at FundCalibre, said it was a “great year” for active management as there were big chunks of every index that were “stuck with the Covid losers”.

Active managers, on the other hand, were able to change position quickly and make the most of valuation opportunities at the bottom of the market, Mr McDermott added.

Tom Sparke, investment manager at GDIM, agreed, saying there were always times when active or passive investing had the upper hand and that the recent environment was one of those favouring active.

Mr Sparke added: “At times when there is a larger divergence between sectors that are thriving and those that are suffering, we would expect more active managers to outperform.

“Avoiding just the very worst of performers can significantly improve performance.”

Turning the tide

The outperformance in 2020 marked a turning point for active managers, which in general have struggled to beat their tracker counterparts over the last five years.

Last year, research from Albemarle Street Partners revealed just 40 per cent of active funds had returned more than passive equivalents since 2015.

Money has been flowing from active to passive strategies since 2018 as active funds’ underperformance coupled with Mifid rules which highlighted the extra cost of active management encouraged investors to change tack.

Recent data from Morningstar estimates that £33.1bn was pumped into passive funds in 2020, with active funds seeing just £2.6bn of net inflows throughout the year.

Looking forward, Ben Yearsley, investment consultant at Fairview Investing, said the last year would not "change much". He said: "Active proponents will still champion their corner as will passive.

"What it does show is that in times of volatility active can outperform and probably should. In strongly rising markets it's tough for active to perform better, but in sideways, falling or volatile markets that's their opportunity."

Mr Sparke agreed, saying there was a case for both styles in a diversified portfolio, but warned that passives were likely to perform better in the near future as “the rising tide lifts all ships”.

But Mr McDermott expected good active managers to continue to perform over the long-term. He said: “There is no better example of that than very recently, when Tesla was added to the S&P 500.

“Do you want to own a large part of that in a passive today, or would you rather your manager had invested a year ago? Passives have their uses, but cheapest is not always best."

imogen.tew@ft.com

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know